condition

- If the client does not fulfill his obligations to repay the loan, under the loan agreement, a daily penalty of 1% will be charged on the amount of the overdue part of the loan. In case of failure to fulfill its obligations, the bank has the right to collect the debt in the form of principal, interest and fines in court.

- In case of failure to fulfill its obligations under the loan agreement, the Bank has the right to file a claim in court for the compulsory collection of the loan at the expense of the pledged property.

- According to the Law of the Republic of Tajikistan "On Credit Histories", banks undertake to provide information to the Bureau of Credit Histories in strict accordance with the available information about the subject of credit history.

- If the collateral is not sufficient to cover the loan, within the framework of the current legislation of the Republic of Tajikistan, the Bank has the right to apply to the court to collect the debt at the expense of the client's other assets.

- Within the framework of the current legislation of the Republic of Tajikistan, the Bank has the right to apply to the court for debt collection at the expense of other available assets of the client.

SME BUSINESS

This loan product is offered to a wide range of SME enterprises, female borrowers and customers who are involved in trade, manufacturing and service business.

|

Purpose |

Only working capital, liquidity support etc. |

Only acquisition of fixed assets and business expansion purposes or increasing the production capacity |

|

Minimum loan size |

USD 10,000 or its TJS equivalent |

USD 10,000 or its TJS equivalent. |

|

Maximum loan size |

USD 300,000 or its TJS equivalent. |

USD 300,000 or its TJS equivalent. |

|

Currency |

TJS / USD |

TJS / USD |

|

Minimum loan term |

3 months |

6 months |

|

Maximum loan term |

24 months |

48 months |

|

Grace period |

Up to 3 months for principal amount only, which can be given to the customer as per the Loan utilization plan in the beginning or middle of loan repayment based on the business cash flow and seasonality factors |

Up to 6 months for principal amount only, which can be given to the customer as per the Loan utilization plan in the beginning or middle of loan repayment based on the business cash flow and seasonality factors |

|

Minimum customer contribution |

Not required |

30% of fixed assets or expansion budget |

|

Processing fee |

According to the Bank’s tariffs |

|

|

Guarantor |

Guarantor is required for this facility loans above USD 2,000 (of TJS equivalent) and above USD 3,000 if the customer is in premier or advantage group and full financial analysis of the guarantor is required. |

|

|

Collateral |

Refer to Loan security requirements. |

|

|

Interest rates |

Refer to the Loan Products Pricing Matrix |

|

|

Interest accruals |

Daily, declining balance |

|

|

Loan repayment |

Monthly, equal installment –annuity or equal principal amount method. Changes in foreign exchange rates may affect loan payments of USD loans. |

|

|

Early closure or partial prepayments |

Allowed with the condition to formally report but no penalties as per NBT requirements. |

|

|

Credit Analysis |

Thorough credit analysis is required for all loans and segment of customers. |

|

MF BUSINESS

This loan product is offered to a wide range of micro enterprises, female borrowers and customers who are involved in trade, manufacturing and service business.

|

Purpose |

Only working capital, liquidity support etc.

|

Only acquisition of fixed assets and business expansion purposes or increasing the production capacity |

|

Minimum loan size |

USD 100 or its TJS equivalent. |

USD 100 or its TJS equivalent. |

|

Maximum loan size |

USD 10,000 or its TJS equivalent |

USD 10,000 or its TJS equivalent |

|

Currency |

TJS / USD |

TJS / USD |

|

Minimum loan term |

3 months |

6 months |

|

Maximum loan term |

24 months |

48 months |

|

Grace period |

Up to 2 months for principal amount only, which can be given to the customer as per the Loan utilization plan in the beginning or middle of loan repayment based on the business cash flow and seasonality factors |

Up to 4 months for principal amount only, which can be given to the customer as per the Loan utilization plan in the beginning or middle of loan repayment based on the business cash flow and seasonality factors |

|

Minimum customer contribution |

Not required |

30% of the fixed asset price or expansion budget |

|

Processing fee |

According to the Bank’s tariffs |

|

|

Guarantor |

Guarantor is required for loans above USD 2,000 (or TJS equivalent) and above USD 3,000 (or TJS equivalent) if the customer is in premier or advantage group. The full financial analysis of the guarantor is required. |

|

|

Collateral |

Refer to Loan security requirements. |

|

|

Interest rates |

Refer to the Loan Products Pricing Matrix |

|

|

Interest accruals |

Daily, declining balance |

|

|

Loan repayment |

Monthly, equal installment –annuity or equal principal amount method. Changes in foreign exchange rates may affect loan payments of USD loans. |

|

|

Early closure or partial prepayments |

Allowed with the condition to formally report but no penalties as per the NBT requirements. |

|

|

Credit Analysis |

Thorough credit analysis is required for all loans and segment of customers. |

|

This loan product is offered to a wide range of micro and SME enterprises, farmers, female borrowers and customers who are involved in trade, manufacturing, service business and agriculture and provide gold as collateral. Also, this product can be used for consumption and housing purposes.

|

Purpose |

Only working capital, liquidity support etc.

|

Only acquisition of fixed assets and business expansion purposes or increasing the production capacity as well as consumption and housing |

|

Minimum loan size |

USD 100 and its TJS equivalent. |

USD 100 and its TJS equivalent. |

|

Maximum loan size |

USD 100,000 and its TJS equivalent. |

USD 100,000 and its TJS equivalent. |

|

Currency |

TJS / USD |

TJS / USD |

|

Minimum loan term |

3 months |

6 months |

|

Maximum loan term |

24 months |

48 months |

|

Grace period |

Up to 2 months for principal amount only, which can be given to the customer in the beginning or middle of loan repayment based on the business cash flow and seasonality factors |

Up to 4 months for principal amount only, which can be given to the customer in the beginning or middle of loan repayment based on the business cash flow and seasonality factors |

|

Processing fee |

According to the Bank’s tariffs |

|

|

Guarantor |

Not required. |

|

|

Collateral |

Cash and Gold. Refer to Loan security requirements. |

|

|

Interest rates |

Refer to the Loan Products Pricing Matrix |

|

|

Interest accruals |

Daily, declining balance |

|

|

Loan repayment |

Monthly, equal installment –annuity or equal principal amount method. Changes in foreign exchange rates may affect loan payments of USD loans. |

|

|

Early closure or partial prepayments |

Allowed with the condition to formally report but no penalties as per the NBT requirements. |

|

|

Credit analysis |

Only KYC check is required. |

|

SME AGRICULTURE

This loan product is specifically targeted at farmers and female borrowers engaged in agricultural income generating activities.

|

Purpose |

Only crop growing, livestock rearing, etc. |

Only acquisition of fixed assets, food processing, business expansion purposes or increasing the production capacity, improving food storing, etc. |

|

Minimum loan size |

TJS equivalent of USD 10,000 |

TJS equivalent of USD 10,000 |

|

Maximum loan size |

TJS equivalent of USD 100,000 |

TJS equivalent of USD 100,000 |

|

Currency |

TJS |

TJS |

|

Minimum loan term |

3 months |

6 months |

|

Maximum loan term |

18 months |

48 months |

|

Grace period |

Up to 9 months for principal amount only for crop growing |

Up to 9 months for principal amount only, which can be given to the customer as per the Loan utilization plan in the beginning or middle of loan repayment based on the business cash flow and seasonality factors |

|

Minimum customer contribution |

Not required |

30% of the fixed asset price or expansion budget |

|

Processing fee |

According to the Bank’s tariffs |

|

|

Guarantor |

Guarantor is required for loans above USD 2,000 (or TJS equivalent) and above USD 3,000 (or TJS equivalent) if the customer is in premier or advantage group. The full financial analysis of the guarantor is required. |

|

|

Collateral |

Refer to Loan security requirements. |

|

|

Interest rates |

Refer to the Loan Products Pricing Matrix |

|

|

Interest accruals |

Daily, declining balance |

|

|

Loan repayment |

Monthly, equal installment –annuity or equal principal amount method. |

|

|

Early closure or partial prepayments |

Allowed with the condition to formally report but no penalties as per the NBT requirements. |

|

|

Credit Analysis |

Thorough credit analysis is required for all loans and segment of customers. |

|

MF AGRICULTURE

This product is specifically targeted at farmers and female borrowers engaged in agricultural income generating activities.

|

Purpose |

Only crop growing, livestock rearing, etc. |

Only acquisition of fixed assets, food processing, business expansion purposes or increasing the production capacity, improving food storing, etc. |

|

Minimum loan size |

TJS equivalent of USD 100 |

TJS equivalent of USD 100 |

|

Maximum loan size |

TJS equivalent of USD 10,000 |

TJS equivalent of USD 10,000 |

|

Currency |

TJS |

TJS |

|

Minimum loan term |

3 months |

6 months |

|

Maximum loan term |

18 months |

36 months |

|

Grace period |

Up to 9 months for principal amount only for crop growing |

Up to 9 months for principal amount only, which can be given to the customer as per the Loan utilization plan in the beginning or middle of loan repayment based on the business cash flow and seasonality factors |

|

Minimum customer contribution |

Not required |

30% of the fixed asset price or expansion budget |

|

Processing fee |

According to the Bank’s tariffs |

|

|

Guarantor |

Guarantor is required for loans above USD 2,000 (or TJS equivalent) and above USD 3,000 (or TJS equivalent) if the customer is in premier or advantage group. The full financial analysis of the guarantor is required. |

|

|

Collateral |

Refer to Loan security requirements. |

|

|

Interest rates |

Refer to the Loan Products Pricing Matrix |

|

|

Interest accruals |

Daily, declining balance |

|

|

Loan repayment |

Monthly, equal installment –annuity or equal principal amount method. |

|

|

Early closure or partial prepayments |

Allowed with the condition to formally report but no penalties as per the NBT requirements. |

|

|

Credit Analysis |

Thorough credit analysis is required for all loans and segment of customers. |

|

SME COTTON

Cotton Loan is designed for cotton growing farmers. With a maximum amount of TJS equivalent of USD 100,000 this loan product is offered only in cotton growing areas like Khatlon and Sogd regions.

|

Purpose |

This product can be used for procurement of agricultural inputs, processing, storage and marketing of cotton produce. |

|

Minimum loan size |

TJS equivalent of USD 10,000 |

|

Maximum loan size |

TJS equivalent of USD 100,000 |

|

Currency |

TJS |

|

Minimum loan term |

3 months |

|

Maximum loan term |

48 months |

|

Grace period |

Up to 9 months for principal amount only for cotton growing |

|

Processing fee |

According to the bank’s tariffs |

|

Guarantor |

Guarantor is required for loans above USD 2,000 (or TJS equivalent) and above USD 3,000 (or TJS equivalent) if the customer is in premier or advantage group. The full financial analysis of the guarantor is required. |

|

Collateral |

Refer to Loan security requirements |

|

Interest rates |

Refer to the Loan Products Pricing Matrix |

|

Interest accruals |

Daily, declining balance. |

|

Loan repayment |

Monthly, equal installment –annuity or equal principal amount method. |

|

Early closure or partial prepayments |

Allowed with the condition to formally report but no penalties as per the NBT requirements. |

|

Credit Analysis |

Thorough credit analysis is required for all loans and segment of customers. |

MF COTTON

Cotton Loan is designed for cotton growing farmers. With a maximum amount of TJS equivalent of USD 10,000 this loan product is offered only in cotton growing areas like Khatlon and Sogd regions.

|

Purpose |

This product can be used for procurement of agricultural inputs, processing, storage and marketing of cotton produce. |

|

Minimum loan size |

TJS equivalent of USD 100 |

|

Maximum loan size |

TJS equivalent of USD 10,000 |

|

Currency |

TJS |

|

Minimum loan term |

3 months |

|

Maximum loan term |

36 months |

|

Grace period |

Up to 9 months for principal amount only for cotton growing |

|

Processing fee |

According to the bank’s tariffs |

|

Guarantor |

Guarantor is required for loans above USD 2,000 (or TJS equivalent) and above USD 3,000 (or TJS equivalent) if the customer is in premier or advantage group. The full financial analysis of the guarantor is required. |

|

Collateral |

Refer to Loan security requirements. |

|

Interest rates |

Refer to the Loan Products Pricing Matrix |

|

Interest accruals |

Daily, declining balance |

|

Loan repayment |

Monthly, equal installment –annuity or equal principal amount method. |

|

Early closure or partial prepayments |

Allowed with the condition to formally report but no penalties as per the NBT requirements. |

|

Credit Analysis |

Thorough credit analysis is required for all loans and segment of customers. |

CONSUMPTION

This facility is offered to a wide range of micro enterprises, SME, female borrowers, farmers and all employees working with governmental and private entities.

|

Purpose |

These loans can be used to fulfil a variety of general consumption needs that will allow customers to improve their quality of life. These include payment for household items, education, medical treatment, social events (e.g. marriage), tourism, etc. |

|

Minimum loan size |

USD 100 and its TJS equivalent |

|

Maximum loan size |

USD 20,000 and its TJS equivalent TJS 60,000 for rural areas. No USD lending in rural areas. |

|

Currency |

TJS / USD |

|

Minimum loan term |

1 month |

|

Maximum loan term |

48 months – TJS loans and 36 months – USD loans |

|

Grace period |

1 month |

|

Minimum customer share |

Not required |

|

Processing fee |

According to the bank’s tariffs |

|

Guarantor |

Guarantor is required for loans above USD 2,000 (or TJS equivalent) and above USD 3,000 (or TJS equivalent) if the customer is in premier or advantage group. The full financial analysis of the guarantor is required. |

|

Collateral |

Refer to Loan security requirements. |

|

Interest rates |

Refer to the Loan Products Pricing Matrix |

|

Interest accruals |

Daily, declining balance |

|

Loan repayment |

Monthly, equal installment –annuity or equal principal amount method. Changes in foreign exchange rates may affect loan payments of USD loans. |

|

Early closure or partial prepayments |

Allowed with the condition to formally report but no penalties as per the NBT requirements. |

|

Credit Analysis |

Thorough credit analysis is required for all loans and segment of customers. |

AUTO LOAN

This loan product is offered to all employees working with governmental and private entities and MSME owners.

|

Purpose |

Auto loans are offered to individuals, mostly in urban and semi-urban areas for purchase of an automobile for personal use. No car brand restrictions.

|

|

Minimum loan size |

USD 500 and its TJS equivalent |

|

Maximum loan size |

USD 15,000 and its TJS equivalent |

|

Currency |

TJS / USD |

|

Minimum loan term |

1 month |

|

Maximum loan term |

48 months – TJS loans and 36 months – USD loans |

|

Grace period |

1 month |

|

Processing fee |

According to the bank’s tariffs |

|

Minimum customer contribution |

20% of automobile price for loans above USD5k |

|

Guarantor |

Guarantor is required for loans above USD 2,000 (or TJS equivalent) and above USD 3,000 (or TJS equivalent) if the customer is in premier or advantage group. The full financial analysis of the guarantor is required. |

|

Collateral |

Refer to Loan security requirements. |

|

Interest rates |

Refer to the Loan Products Pricing Matrix |

|

Interest accruals |

Daily, declining balance |

|

Loan repayment |

Monthly, equal installment –annuity or equal principal amount method. Changes in foreign exchange rates may affect loan payments of USD loans. |

|

Early closure or partial prepayments |

Allowed with the condition to formally report but no penalties as per the NBT requirements. |

|

Credit Analysis |

Thorough credit analysis is required for all loans and segment of customers. |

HOUSING LOANS

This facility is offered to a wide range of micro enterprises, SME, female borrowers, farmers and all employees working with governmental and private entities.

|

Purpose |

House improvement |

Energy efficiency |

Construction

|

House purchase in urban areas |

|

Minimum loan size |

USD 100 and its TJS equivalent |

USD 100 and its TJS equivalent |

USD 500 and its TJS equivalent |

USD 2,000 and its TJS equivalent |

|

Maximum loan size |

USD 20,000 and its TJS equivalent |

USD 20,000 and its TJS equivalent |

USD 30,000 and its TJS equivalent |

USD 50,000 and its TJS equivalent |

|

Currency |

TJS / USD |

TJS / USD |

TJS / USD |

TJS / USD |

|

Minimum loan term |

3 months

|

3 months

|

3 months

|

6 months

|

|

Maximum loan term |

48 months for TJS 36 months for USD |

48 months for TJS 36 months for USD |

120 months for TJS 96 months for USD |

120 months for TJS 96 months for USD |

|

Grace period |

1 month |

1 month |

1 month |

1 month |

|

Minimum customer contribution |

Not required |

Not required |

30% of budget |

30% of house price |

|

Processing fee |

According to the Bank’s tariffs |

|||

|

Guarantor |

Guarantor is required for loans above USD 2,000 (or TJS equivalent) and above USD 3,000 (or TJS equivalent) if the customer is in premier or advantage group. The full financial analysis of the guarantor is required. |

|||

|

Collateral |

Refer to Loan security requirements. For the house purchase loans, the security coverage will always be in the shape of related property. No discount for such collaterals is required if the customer minimum contribution for the purchase property is equal or above 30%. |

|||

|

Interest rates |

Refer to the Loan Products Pricing Matrix |

|||

|

Interest accruals |

Daily, declining balance |

|||

|

Loan repayment |

Monthly, equal installment –annuity or equal principal amount method. Changes in foreign exchange rates may affect loan payments of USD loans. |

|||

|

Early closure or partial prepayments |

Allowed with the condition to formally report but no penalties as per the NBT requirements. |

|||

|

Credit Analysis |

Thorough credit analysis is required for all loans and segment of customers. |

|||

|

Other requirements |

For House Improvement, Energy Efficiency and Construction, the customer should provide the photos of targeted house and the expenses classification. For house construction the time of construction should be recorded in the credit files for monitoring and control purposes. The loans for construction should be disbursed in tranches as per the stage of completion of the plan to be verified by the concerned Bank’s staff. The probability of successful completion of Construction loans is assessed by Loan Officers through detailed examination of each loan application, schedule of construction, associated costs and market analysis and is reflected in the loan’s business plan. Before approval of each tranche, the Credit Administrator must confirm whether the probability remains the same or has changed since the previous tranche. |

|||

loan security requirements

|

№ |

Loan size |

Type of accepted collateral |

|||||

|

1 |

Up to USD 2,000 ( or TJS equivalent) and up to USD 3,000 (or TJS equivalent) for advantage or premiere customers |

Without collateral |

|||||

|

2 |

Above and up to USD 4 000 (or TJS equivalent) and above and up to USD 5 000 (or TJS equivalent) only for advantage and premier customers |

Household items |

Livestock |

Equipment |

Gold |

Vehicle |

Cash |

|

3 |

Above and up to USD 5 000 (or TJS equivalent) and above and up to USD 6 000 (or TJS equivalent) only for advantage and premier customers |

Vehicle |

Equipment |

Gold |

Property (notary registered) |

Cash |

|

|

4 |

Above and up to USD 10 000 (or TJS equivalent) |

Insured equipment (notary certified) |

Vehicle |

Property (notary registered) |

Gold |

Cash |

|

|

5 |

Above USD 10 000 (or TJS equivalent) |

Gold |

Property (notary registered) |

Cash |

|||

The annual effective interest rate is a percentage expression, according to which the interest on the loan is calculated taking into account all payments of the client for servicing the loan of the credit institution;

CJSC First Microfinance Bank includes in the agreement the interest rate on the loan and the annual effective interest rate on the loan.

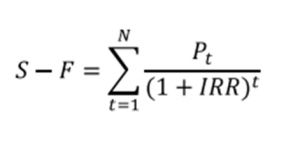

The annual effective interest rate on loans is calculated as follows:

Pt - payments for the period;

t- (1, ...., N) number of periods (day, month and year);

S - the amount of the loan provided;

F - costs associated with servicing when obtaining a loan;

IRR is the annual effective interest rate.